How MHI Plans to Deliver Sustainable Growth

Based on the FY2024-2026 Medium-Term Business Plan (MTBP) released in May and which builds on the record FY2023 financial results, MHI is back in growth mode.

Over the next three years, MHI expects revenues to increase by at least 20% to ¥5.7 trillion, with business profit rising at least 60% to ¥450 billion. Our return on equity will continue to improve, reaching a minimum of 12%. After recovering from several tough years at the start of this decade and strengthening MHI’s financial and operational foundations, we are set to deliver a growth ‘boost’ to stakeholders.

MTBP: MHI’s Strategic Roadmap

Before detailing the sources of this growth, it is important to understand the significance of the MTBP to an organisation like MHI. Put simply, it is our strategic roadmap. Senior management is guided by it and treats the financial targets as commitments. We use it to inform investors and financial analysts that there is industrial logic underlying our diverse spread of businesses and therefore our stock does not deserve a conglomerate discount.

For 80,000 employees around the world, meanwhile, the MTBP provides a common direction, something we amplify with town hall meetings and internal messaging. Both externally and internally, we use the MTBP to reinforce our commitment to MHI’s mission of using its cutting-edge technology and many years of expertise to develop solutions to some of the world’s most challenging problems – from the energy transition to national security.

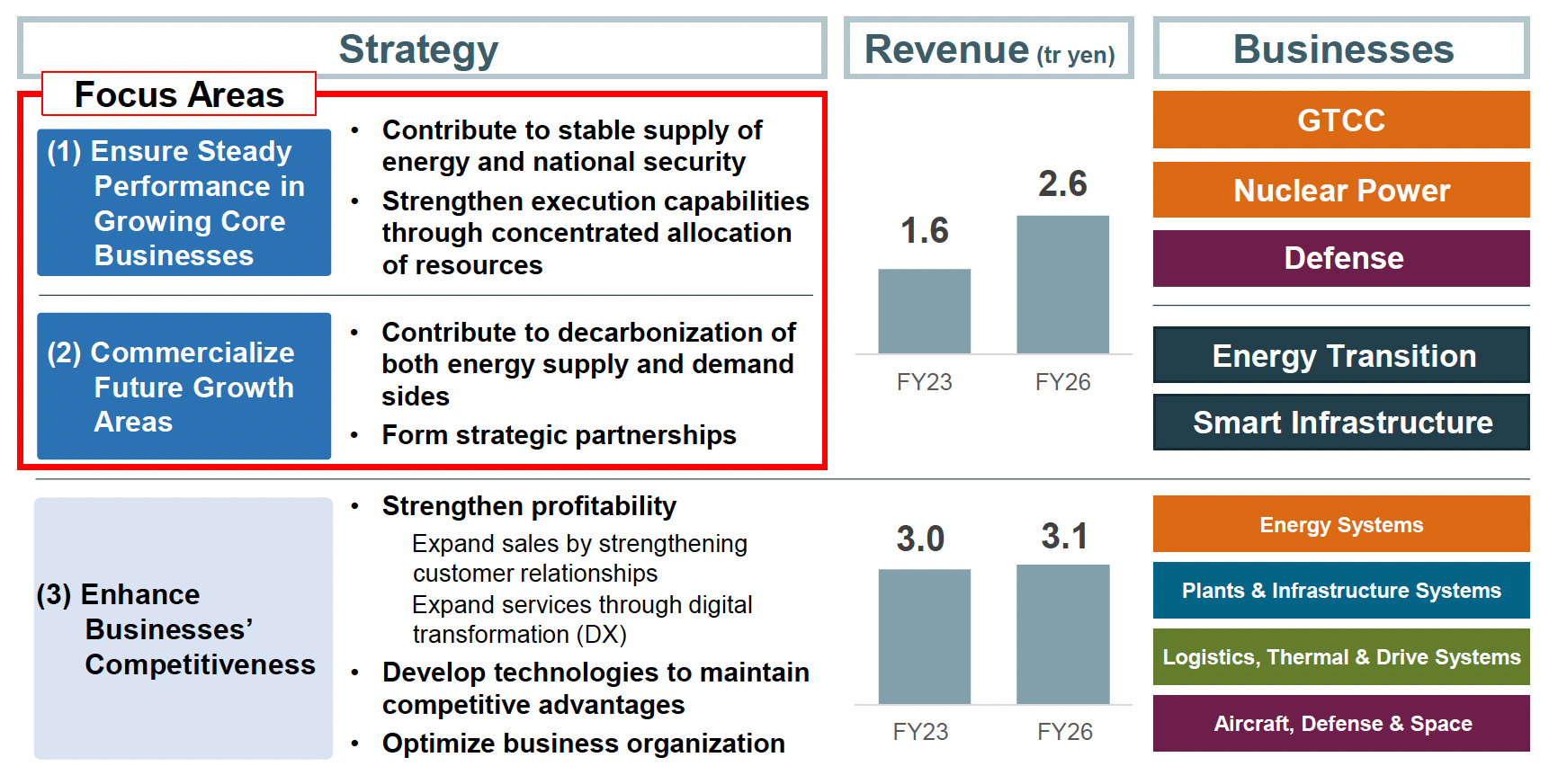

Focus Areas: Accelerating Growth Opportunities

So, where do we see growth over the next three years? The bulk of it will come from a set of core businesses that are already profitable and cash generative but have significant opportunities for further expansion. Gas Turbine Combined Cycle (GTCC), where we are world leaders, nuclear power and defense are in this category.

These businesses are benefiting from secular tailwinds: growing demand for clean, stable flexible power to accelerate electrification and decarbonization; and a surge in military spending amid rising geopolitical tensions.

At the same time, we will continue to invest in future growth areas. Primarily, this means the development of hydrogen/ammonia and CO₂ capture, utilisation and storage (CCUS) value chains. These are long-term, strategic initiatives whose ultimate potential is still uncertain and depends on factors outside our control, like regulatory progress and government incentives. That means we need to continue to assess them on a scientific basis, without emotion, and it will probably take longer than three years to reap significant commercial returns.

However, as an ‘enabler’ of the energy transition, MHI must invest and develop technology in anticipation of customer needs. This is the rationale behind our 2040 MISSION NET ZERO declaration. And we are walking our talk: take our development of hydrogen co-firing gas turbines; in Utah, we are developing a giant hydrogen storage hub that will supply the clean gas to such turbines at a nearby power plant from 2025; or the elimination of 97.7% of Scope 1 & 2 emissions at our Mihara Machinery Works in Japan.

The creation of a new business domain, Green Transformation (GX) Solutions, is a further proof of our strategic commitment. It will manage and foster synergies between all of our energy transition businesses.

Of course, we are investing not only on the energy supply side but also when it comes to energy demand solutions. A good example is supplying power and cooling equipment for data centers – another high-growth area where MHI is determined to be a major player.

Investing in Transformation

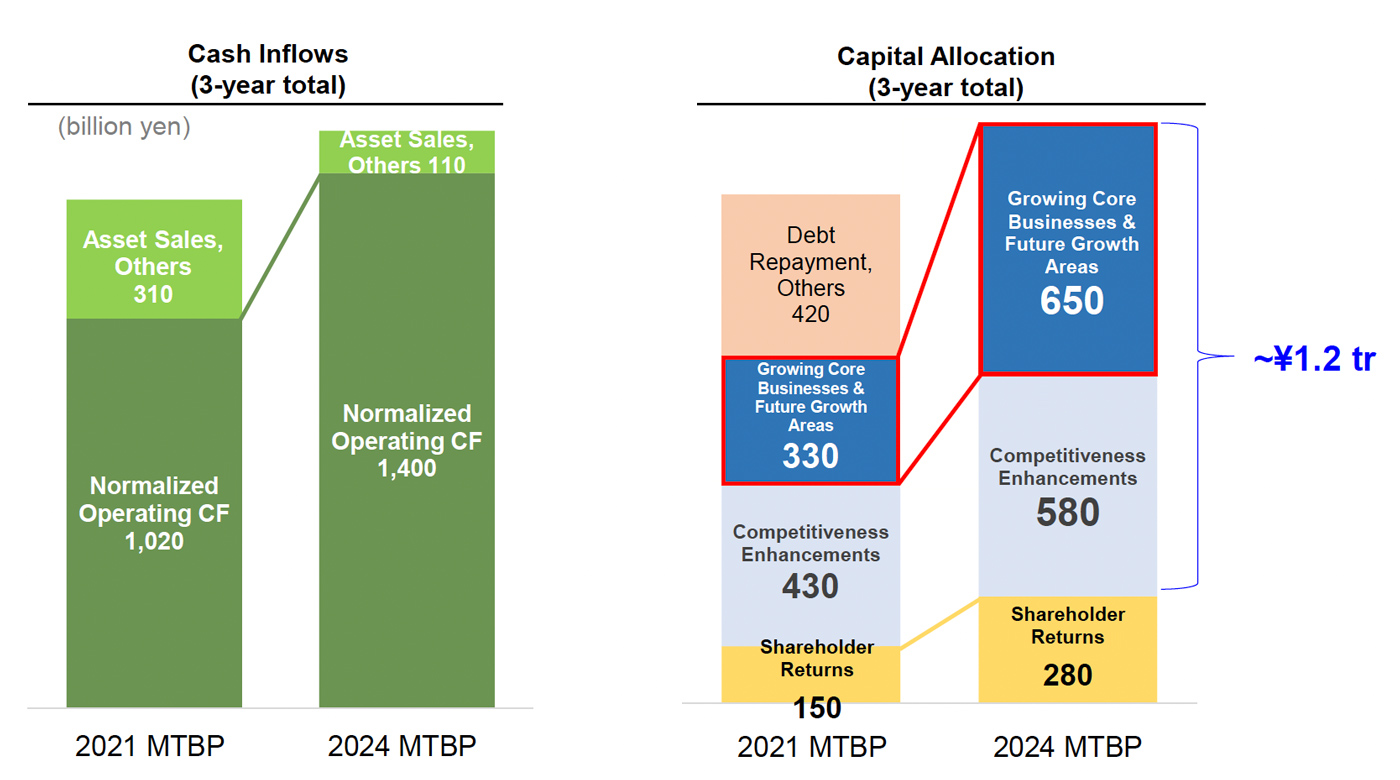

We recognise that it will take significant investment to compete in such high-potential markets. As a result, we are doubling our investment into the ‘focus areas’ to ¥650 billion over the next three years, funded by a significant improvement in cash generation.

The reorganisation of our R&D function into smaller, more agile units over the past several years has given us the internal capacity to efficiently invest more money across a wider range of basic technologies and to develop more products more rapidly.

This investment would not be possible if the rest of MHI was not performing steadily and efficiently. Businesses like infrastructure systems, logistics, HVAC and aerospace remain as important as ever to strengthen the group and have their own opportunities for growth.

One of my key roles as Chief Strategic Officer is to support all strategic business units in developing and achieving their growth targets and to encourage the exchange of ideas, best practices and personnel across this huge and diverse organisation.

As we execute on our MTBP over the next three years, we will strive not only to achieve its financial targets and to invest for the future but also to continue to strengthen our technology know-how and the human and intellectual capital that are the foundation of long-term success. And that will allow us to deliver MHI’s vision of achieving net zero and building a safer, more secure and more comfortable world.